Unlocking Time: Expert Insights on Watch Collection Value and Investment Strategies

In a world where every second counts, timepieces have transcended their utilitarian roots to become symbols of artistry, heritage, and sophistication. The intricate dance of gears and springs within a watch not only keeps time but also encapsulates histories, innovations, and aspirations. For collectors and investors alike, the allure of horology extends beyond mere aesthetics; it is an opportunity to unlock the hidden value within these miniature masterpieces. In this article, we delve into the multifaceted realm of watch collecting, exploring expert insights on how to navigate the intricate balance of value appreciation and investment strategies. Whether you are a seasoned collector or a newcomer intrigued by the ticking treasures of the past, this guide aims to illuminate the path to understanding the financial potential of your wristwatch ensemble. Join us as we discover how to make informed choices that not only celebrate the artistry of timekeeping but also offer the promise of sound investment.

Exploring the Timeless Appeal of Luxury Watches in Investment Portfolios

Luxury watches have transcended their original purpose of timekeeping to become symbols of status, craftsmanship, and enduring value. As collectors and investors increasingly gravitate towards these mechanical marvels, the allure lies in their intricate designs and historical significance. When exploring the investment potential of high-end timepieces, three key factors often emerge as pivotal:

- Brand Heritage: Renowned brands like Rolex, Patek Philippe, and Audemars Piguet have long histories that enhance their desirability and resale value.

- Rarity: Limited editions or unique pieces often appreciate significantly due to their scarcity, making them valuable over time.

- Condition and Documentation: Watches that are well-preserved and come with original boxes and papers command higher prices in the secondary market.

Investing in luxury watches not only attracts enthusiasts but also savvy investors looking to diversify their portfolios. The market is robust, often mirroring the trends seen in other collectible assets such as fine art or vintage cars. Observations about investment returns often highlight the following advantages:

| Investment Aspect | Potential Benefits |

|---|---|

| Market Resilience | Luxury watches have proven to hold value even during economic downturns. |

| Liquidity | Several platforms allow for easy buying and selling, ensuring investors can access funds if needed. |

| Passion Asset | Collecting offers personal satisfaction beyond financial returns, appealing to both heart and mind. |

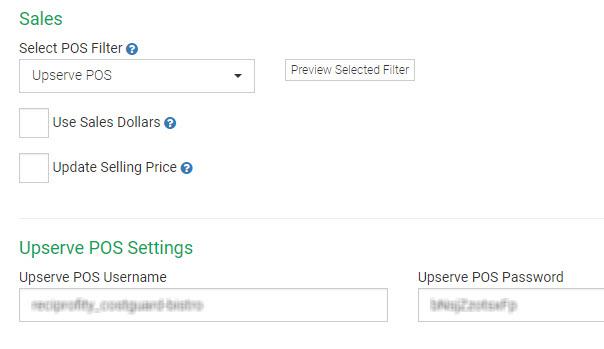

Evaluating Watch Condition and Provenance for Optimal Value Appreciation

To navigate the intricate world of watch collecting, one must meticulously assess the condition of a timepiece. **Cosmetic condition**, encompassing the absence of scratches, dents, and discoloration, plays a crucial role in determining its desirability. There are several factors to consider when evaluating condition:

- Movement Performance: Ensure the watch is running smoothly. A well-maintained movement can significantly enhance value.

- Service History: Regular servicing by reputable watchmakers can indicate care and enhance potential appreciation.

- Original Parts: Watches with all-original components are generally more valuable than those with replaced parts.

Provenance is equally paramount; a watch’s history can tell potential investors much about its future. A timepiece linked to a renowned owner or event often garners increased interest. Key elements to consider include:

- Documentation: Papers including warranties, service records, and original purchase receipts enhance credibility.

- Previous Ownership: Watches with famous past owners or significant historical background can see substantial value spikes.

- Market Trends: Stay informed about trends in the luxury watch market; certain brands and models may become more sought-after due to cultural relevance.

| Condition Factor | Impact on Value |

|---|---|

| Scratches/Dents | -20% |

| Service History | +15% |

| Original Parts | +30% |

| Provenance Element | Value Increase Potential |

|---|---|

| Famous Previous Owner | +50% |

| Complete Documentation | +20% |

| Historical Significance | Varies |

Crafting a Strategic Collection: Diversification and Market Trends to Consider

Building a robust watch collection requires a keen understanding of market trends and a thoughtful approach to diversification. By expanding your portfolio beyond just a few brands or styles, you can mitigate risks and increase potential returns. Consider incorporating timepieces from various categories, such as:

- Luxury Brands – Renowned names like Rolex, Patek Philippe, and Audemars Piguet can offer both prestige and long-term value.

- Independent Watchmakers - Emerging brands often provide unique designs and innovative complications that could appreciate rapidly.

- Vintage Models – Iconic models from previous decades can be an excellent investment due to their scarcity and historical significance.

- Limited Editions – Watches produced in small quantities often attract collectors’ attention, driving up demand and resale value.

Staying informed about current market trends is essential for making savvy investment decisions. Factors that influence watch values include celebrity endorsements, auction results, and emerging demands for sustainable practices. A timely analysis can guide you in prioritizing specific brands or features, such as:

| Trend | Impact on Value |

|---|---|

| Celebrity Ownership | Increased interest and rising prices |

| Technological Innovations | Higher desirability and potential rarity |

| Global Events (e.g., Olympics) | Temporary spikes in specific models |

| Eco-conscious Brands | Growing market share and newer demographics |

This strategic combination of diversification and keen market analysis will empower you to make informed choices, ultimately unlocking the true value of your watch collection.

In Summary

As we draw the curtain on our exploration of watch collection value and investment strategies, it’s evident that timepieces are much more than mere instruments for keeping track of hours. They embody craftsmanship, history, and personal expression, serving as both art and asset. Whether you are a seasoned collector or a novice enthusiast, the insights gleaned from industry experts illuminate a path toward making informed decisions in this unique market. Just as the hands of a watch work in harmony to mark the passage of time, so too must collectors balance their passion with prudent investment strategies.

As you embark on your journey through the world of horology, remember that every tick and tock holds the potential for stories, connections, and value—both sentimental and financial. With knowledge as your guide, may your collection flourish and your passion continue to grow. Here’s to unlocking not just the value of timepieces, but also the moments they inspire along the way.

Comments