In a world where time is often viewed through the lens of fleeting moments and busy schedules, watches serve as more than mere instruments for telling time; they are intricate masterpieces of craftsmanship, history, and style. The art of collecting and investing in watches has emerged as a fascinating intersection of horology and finance, captivating enthusiasts and investors alike. With each tick of a timepiece, there lies a story waiting to be discovered, a potential hidden beneath its polished surface. In this article, we delve into the intricate realm of watch investment strategies, gathering insights from industry experts who navigate the delicate balance between passion and profit. Join us as we explore the essential elements of collecting with purpose, uncovering how to unlock the true value of timepieces in an ever-evolving market. Whether you’re a seasoned collector or a curious newcomer, prepare to unravel the mysteries of watch investment and discover how these timeless treasures can contribute to both personal enjoyment and financial growth.

Understanding Market Trends: Navigating the Watch Investment Landscape

In the realm of horological investments, recognizing and adapting to market trends is essential for both seasoned collectors and novice buyers. The landscape is influenced by factors such as brand reputation, world events, and even social media buzz. To effectively navigate this intricate web, investors should pay close attention to:

- Limited Edition Releases: These often see significant appreciation in value shortly after launch.

- Celebrity Endorsements: Timepieces worn by influential figures can drive demand and price fluctuations.

- Market Cycles: Awareness of economic influences can help in timing acquisitions and sales.

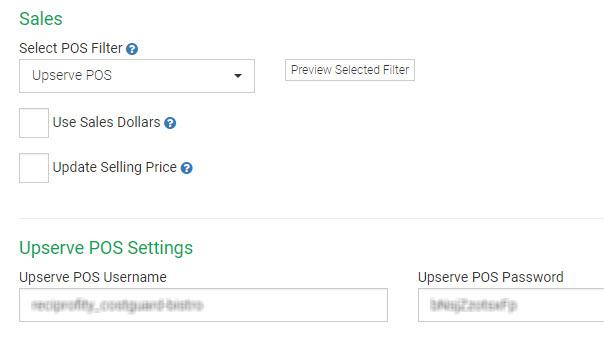

Furthermore, understanding the specifics of watch brands and models can provide valuable insights into long-term investment potential. For example, tables summarizing past performance can highlight trends, helping investors identify which brands have consistently outperformed over the years. Below is a simple overview of some notable brands and their current market sentiment:

| Brand | Current Demand Status | Average Value Growth (%) |

|---|---|---|

| Rolex | High | 8-10 |

| Omega | Moderate | 5-7 |

| Patek Philippe | Very High | 12-15 |

The Art of Timing: When to Buy and Sell for Maximum Returns

Successfully navigating the watch market requires an acute sense of timing, much like the intricate mechanisms found within the timepieces themselves. Understanding market trends and buyer psychology can significantly enhance your chances of maximizing returns. Consider these factors:

- Market Trends: Keep an eye on emerging watch brands or limited editions that generate buzz, as they often appreciate in value swiftly.

- Seasonality: Certain times of the year, especially holidays, see increased demand for luxury items, making it an ideal time for selling.

- Condition and Documentation: Always assess the state of your watch and ensure you have original papers; this can greatly affect a watch’s sellability.

Moreover, timing your entry into the market can also be crucial. Identifying the right moment to buy can lead to significant cost savings and better investment opportunities. Pay attention to:

- Economic Downturns: These may offer buying opportunities as prices often dip, allowing savvy investors to acquire watches at lower prices.

- Brand Announcements: Releases of new models can shift collector focus, allowing you to acquire discontinued models that hold enduring value.

- Auction Timing: The timing of auctions can affect final sale prices; understand the trends of when high-demand watches are sold.

Building a Diverse Collection: Strategies for Curating Value in Your Timepieces

Curating a timepiece collection that stands out requires both an appreciation for aesthetics and a strategic approach to value. **Focus on diversity** by selecting watches from various brands, eras, and styles. This not only enhances the visual richness of your collection but also positions you well for potential appreciation in value. Consider including a mix of luxury watches, vintage pieces, and limited editions. **Key factors** that can contribute to a watch’s worth include rarity, condition, and brand reputation, so keeping these elements in mind while building your collection is paramount. Critical to this aspect is establishing connections with other collectors and watch dealers who can provide insights into emerging trends and undervalued models.

When it comes to selecting specific timepieces, leveraging research can make a significant difference. **Identify trending brands and models** through watch forums, auction results, and collector guides. This can provide clarity on which watches are gaining traction in demand and could appreciate over time. Utilize simple visual indicators in your collection, such as a brand matrix that outlines key brands, model names, and their respective categories. A basic structure could look like this:

| Brand | Model | Category |

|---|---|---|

| Rolex | Submariner | Luxury Diver |

| Patek Philippe | Nautilus | Luxury Sports |

| Omega | Speedmaster | Chronograph |

| Tag Heuer | Monaco | Avant-Garde |

By creating a well-rounded collection that balances popular icons with lesser-known treasures, you not only enrich your watch portfolio but also enhance its potential financial value. Prioritize acquiring pieces with compelling stories and craftsmanship, as these attributes often resonate with future buyers. Combine your passion for horology with patience, as the right timing in curating and selling can yield impressive returns.

Insights and Conclusions

As we draw the curtain on our exploration of watch investment strategies and value collection, it becomes evident that the world of horology is as much about passion as it is about profit. The insights shared by industry experts illuminate a multifaceted landscape where timeless craftsmanship meets strategic foresight.

In the realm of watches, each tick is a testament to innovation and artistry, embodying stories and histories that transcend generations. As you venture into this captivating journey of investing in timepieces, remember that your choices should resonate with both your aesthetic sensibilities and financial wisdom.

Ultimately, investing in watches is not merely a transaction; it’s an opportunity to connect with history, culture, and craftsmanship. Whether you find joy in collecting or seek the thrill of building a portfolio, may your journey be enriched with knowledge and passion. Here’s to unlocking time, one exceptional watch at a time.

Comments